Management System of Star Asia Investment Management Co., Ltd. (Asset Manager)

Star Asia Investment Management Co., Ltd. (Asset Manager), to which Star Asia Investment Corporation (SAR) entrusts the management of its assets, is comprised mainly of a management team with extensive experience and track records in the real estate finance market, staff members who have been working in management of real estate-related assets in Japan at Star Asia and members who have long been engaged in businesses in the field of real estate investment in Japan, and thus possesses high expertise and abundant experience in real estate investment as well as a human network.

We believe that full utilization of the experience and also knowledge and know-how on real estate accumulated by the members at the Asset Manager in investment, operation, management and fund procurement will enable us to realize income stability and growth and to conduct highly transparent management, which we aim for, and lead us to realize the maximization of unitholders’ interests.

Sponsor Support

| Provision of information on properties managed by the sponsor group |

In principle, the sponsor group will, upon selling real estate, etc. held/managed by them, provide such information to SAR and the Asset Manager with no delay in the provision of information to third-parties other than the Asset Manager. |

| Provision of information on properties held by third-parties |

When the sponsor or the sponsor group companies acquire information on sales of real estate, etc. held by third-parties, such information, except for certain cases, will be disclosed to SAR and the Asset Manager. |

| Provision of warehousing function |

In order for SAR to acquire properties smoothly, the Asset Manager may request the sponsor to temporarily own (warehousing) real estate, etc. with the precondition of transferring to SAR, and the sponsor will consider the request in earnest. |

| Provision of human resources |

The sponsor will cooperate in securing necessary human resources within a rational scope while respecting the independence of the Asset Manager. |

| Same-boat investment by the Star Asia Group |

The Star Asia Group owns SAR’s investment units and intends to continue owning them for the time being. Since such ownership of investment units by the Star Asia Group aligns the interests of SAR’s unitholders and the Star Asia Group, leading to stronger support from the Star Asia Group, SAR believes that such will contribute to maximizing its unitholders’ interest. |

Employment of a management fee system linked to net income per unit

■ Management Fee System of the Asset Manager

SAR aims to align interests of unitholders and the Asset Manager by introducing a management fee system in which part of the fees is linked to net income per unit.

| Linked to net income per unit |

SAR believes that the asset management fee system linked to net income per unit will contribute to encouraging the Asset Manager to carry out asset management that gives top priority to improving the income of SAR. |

Diversification of Income Opportunities

■ Investment in mezzanine loan debt

The Asset Manager determines its investment stance believed to be optimal by identifying future trends while analyzing real estate markets and discussing proper investment activities suitable to real estate prices. As part of such an investment stance, the Asset Manager considers investment in mezzanine loan debt mortgaged/backed by real estate, etc. in order to diversify income opportunities and contribute to income stability and the growth of SAR in the real estate market revolving due to economic changes and other factors.

However, the Articles of Incorporation stipulate that investment in mezzanine loan debt be always maintained at 5% or less of total assets of SAR. Furthermore, SAR holds no investments in mezzanine loan debt as of the date of this document and has no specific plans to do so.

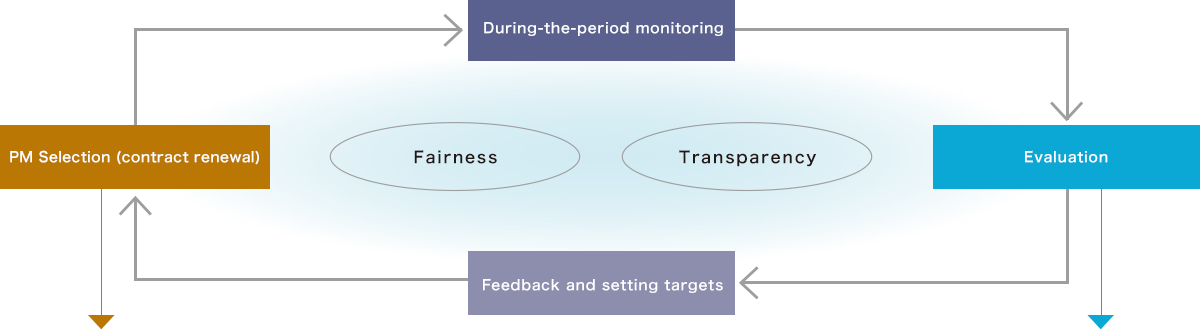

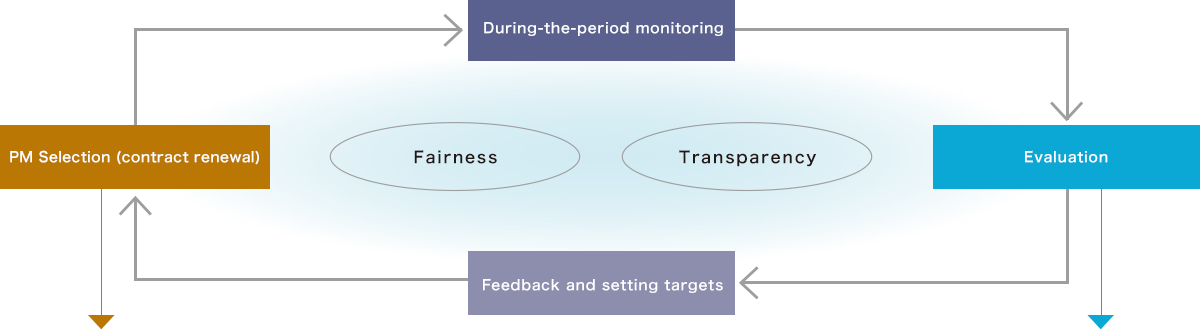

Thorough Implementation of PDCA (Plan・Do・Check・Action) in Property Management

■ Selection Criteria and Monitoring Evaluation Viewpoints for Property Management Companies (PM)

| Major PM Selection Criteria |

| Existence/non-existence of interested parties |

| Comparative track record review of entrusted work of J-REIT |

| Company information |

Time of establishment, number of employees, number of branch offices/shops, number of buildings/units under management, credit assessment, relationship with antisocial forces, etc. |

| Details of entrustment |

PM fee level, transaction record with the Star Asia Group, etc. |

| Internal systems, etc. |

Legal compliance status, information management system, claim management system, countermeasures for conflict of interests |

| Performance assessment |

Ability to respond to tenants, build relationships, lease, report, and manage building management companies |

| Monitoring Evaluation Viewpoint |

| Ability to respond to tenants |

Accepting claims from lessees, responding to delinquent debt, taking care of matters related to move-ins/outs, planning/executing work requested by lessors, revising rent, etc. |

Ability to lease /

results |

Soliciting new tenants, investigating tenant candidates, researching the rental building market, and negotiating renewal terms |

| Ability to report |

Compliance with deadlines of periodical reports (monthly/annual reports, etc.), accuracy, preparation of fiscal year schedule, providing market data information, etc. |

| Ability to manage building management companies |

Managing/supervising building management companies, deciding and ordering minor repairs, advising on major repairs, implementing/reporting building maintenance, negotiating with neighboring owners/residents and reporting of such, negotiating with relevant public offices, etc. |