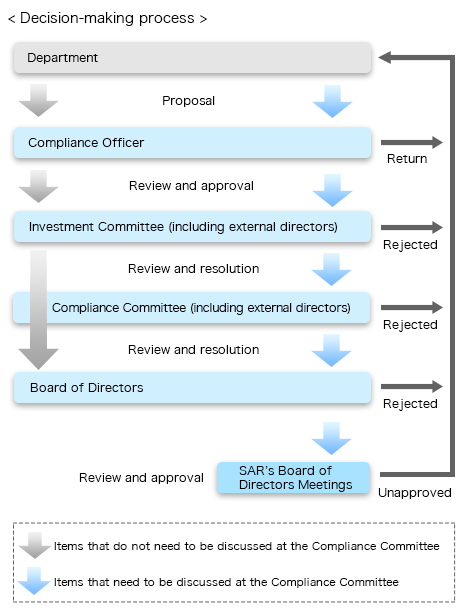

Decision-making process

| ■ | Star Asia Investment Management Co., Ltd. (the“Asset Manager”), to which Star Asia Investment Corporation (“SAR”) entrusts the management of its assets, implements decision-making with high transparency by complying with laws and regulations |

|---|---|

| ■ | The Asset Manager maintains a high sense of ethics and execute operations as a manager of investors' funds |

Same-boat Investments

| ■ | Aligning the interests of the Sponsor Group with those of the unitholders by holding the investment units of the Sponsor Group |

|---|---|

| ■ | Members of the Asset Manager also hold investment units |

Sponsor Group

Please refer to the latest Presentation Material for the number of units and holding ratio.

IR Library:https://starasia-reit.com/en/ir/library.html

Founder of Star Asia 2 individuals

Management team of the Asset Manager

Holding SAR's investment units through the cumulative investment system for employees

High commitment by management

Employees of the Asset Manager

Holding SAR's investment units through the cumulative investment system for employees

Star Asia Group's Code of Conduct

Star Asia, the sponsor of SAR is a non-listed independent investment management group which invests mainly in Japanese real estate-related assets and whose main goal is supplying investors with excellent returns

SAR and Star Asia shall share the same long-term vision in accordance with the Star Asia Group's Code of Conduct, shall be a leading Real estate investment management group in Japan and shall persistently endeavor to continue to be such

The Code of Conduct is as follows:

- 1Client First

-

We are rewarded only when we consistently meet and exceed our investor clients' expectations for the mandates they have given to us.

- 2Highest Ethical

Standards and Integrity -

We always abide by the highest ethical standards and integrity. Unethical actions by an employee could easily destroy the group's long-standing reputation and trust.

- 3Creativity

-

We utilize our experience, persistence, and creativity to identify and monetize investment opportunities which may not be immediately apparent to our competitors.

- 4Respect for Others

-

We treat our investor clients, employees, trade counterparties, and vendors with the utmost respect, and always strive to be trustworthy partner.

- 5Collaborative and

Cooperative Culture -

We succeed only when we work together by fully utilizing our collective strengths in a cooperative manner to serve our investor clients. The group's performance always exceeds the sum of our individual performances.

- 6Adaptability

-

We stay nimble, proactive and critical, allowing us to adjust quickly as the market environment changes in order to continue to be a successful leader in the market where we do business.

- 7Meritocracy

-

We reward our employees for their specific personal performance as well as their contribution to the group and to investor client performance.

- 8Endless Pursuit of

Excellence -

We will tirelessly pursue excellence not only for our investor clients but also for ourselves.

Asset Management Fees

SAR calculates the asset management fees it pays to its asset management company, Star Asia Investment Management Co., Ltd, for daily asset management operations based on the following framework (as approved at the unitholders’ meeting in October 2025):

| ・ | The fee structure is designed to enhance alignment between “maximizing unitholder value” and “incentive structure of the asset management fees”, taking into consideration factors such as borrowing costs. |

|---|---|

| ・ | The fees are linked to the distribution per unit and asset size targets set forth in the New Medium-Term Plan. |

| <Fees for daily management operations> | Calculation formula |

|---|---|

| Management fee | net income per unit(Note 1) x total appraised value of assets under management(Note 2) x 0.000125% (upper limit) |

| (Note 1) | The “net income per unit” serving as the basis for the interim fee calculation formula refers to the amount obtained by dividing pre-tax net income for the period (excluding gains/losses on sale of real estate, etc., and negative goodwill; before deduction of goodwill amortization, interim fees, and non-deductible consumption tax, etc.) by the total number of investment units issued asof the end of the relevant fiscal period (fractions less than one yen are rounded down). |

|---|---|

| (Note 2) | The “total appraised value of assets under management” serving as the basis for the interim fee calculation formula referstothe total amount calculated by taking the appraised value of each asset under management, as determined in accordance with the appraisal method prescribed for each asset type, multiplying it by the actual number of days each asset was held during the fiscal period, and dividing by the number of days in the fiscal period. |

| <Other fees> | Calculation formula |

|---|---|

| Acquisition fee | Acquisition price x 1%(Note 1) (upper limit) |

| Transfer fee | Assignment price x 1%(Note 1) (upper limit) |

| Merger fee | Valuation amount of held assets(Note 2)x 1%(Note 3) (upper limit) |

| (Note 1) | 0.5% if SAR transact with its interested parties. |

|---|---|

| (Note 2) | Merger fee means, in the case where the assets etc. held by SAR’s counterparty of a consolidation-type merger or absorption-type merger are investigated and evaluated and other operations related to the merger are conducted with respect thereto, and such merger comes into effect, a fee calculated by multiplying a rate to be separately agreed with the asset management company capped at 1% to the total valuation amount as of the date of effectuation of the real estate related assets which are succeeded by or held by the relevant newly established consolidated company or the relevant surviving company of the absorption-type merger, within the real estate related assets held by the relevant counterparty. |

| (Note 3) | 0.5% if the Investment Corporation merges with an investment corporation that falls within the category of interested parties as defined in the Interested Party Transaction Regulations of the Asset Management Company, or an investment corporation for which any of the interested parties is entrusted with the management of assets. |

Basic Policy on the “Principles for Customer-Oriented Business Conduct”

The Asset Manager is firmly committed to the asset management of SAR with the objective of maximizing value for investors. As part of these activities, the Asset Manager has adopted the Principles for Customer-Oriented Business Conduct announced on March 30, 2017 by the Financial Services Agency and has established policies for activities that comply with these principles.

For details, please visit the following website : https://starasia-im.com/

Training programs for employees

The Asset Manager is Conducting ESG and Compliance training programs as follows for all employees.

| FY 2023 | FY 2024 |

|---|---|

| 9 times | 7 times |

Training Theme

・Conflicts of interest and Compliance Attitude

・Information Management

・Anti-Social Forces, Money laundering, Internal complaint

・Trends in Anti-Fraud Practices

・ESG Fundamentals

・Human Rights in ESG